Short Term Loans

Even if you are able to manage your money well, many can find themselves in a difficult financial situation where a short term loan can help.

Getting short term loans like payday loans for fast cash can help solve an immediate financial problem. Borrowers pay back short term loans within a few weeks, so there is no long-term debt. Short term borrowers can simply fix the problem and move on. When it comes to keeping up with payments or handling expenses, sometimes timing is the most important factor. Short term loans help borrowers stay financially on schedule because they arrive in the borrowers bank account via direct deposit sometimes within a day.

Short Term Loans Online

If you’re thinking of applying for instant short term loans with bad credit, or even no credit, you’ll be glad to know that through the network of lenders we work with that Personal Money Network can probably help. For installment loans the best place to start is to apply, then wait to see if your application will be approved.

Since we work with a number of lenders, we make it easier to be approved than when applying to a single direct lender. In fact, you might say your odds are improved, making Personal Money Network an option to consider. When you can use fast cash even with bad credit installment loans can be an option.

Can I get a short term loan with bad credit?

Even with bad credit a short term loan is an option for most. Many will apply with poor credit, and Personal Money Network and lenders they work with helps those needing a short term loan find a lender.

What is a short term loan?

A short term loan (or short time loan) is an instant loan for when you are having financial issues and could use a small loan until back on your feet.

How do I apply for a short term loan?

Applying for short term loans is easy, where you complete an online application and receive word of whether you have been approved rather quickly. By completing the online application for a short term loan you are one step closer to getting a decision.

How does a short term loan work?

A short term loan is an easy alternative that is especially beneficial if you have poor or bad credit, and typically repaid after a few payments over a short term.

Continue reading below for more on short term personal loans.

Short Term Loans Online

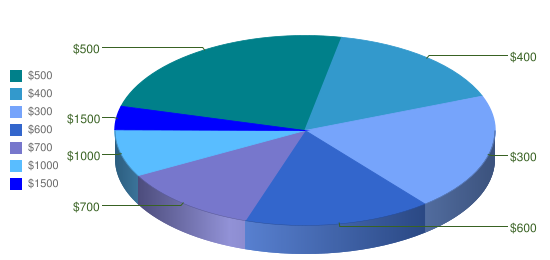

Short term loans online are generally between $100 and $1,500. For first time borrowers however the average is 300 dollar to 500 dollar, and up to 1000 dollar loans are an option. Keeping the amount you request low greatly increases your chances of getting an instant decision.

If you are in need of payday loans we are here to help with that too. We work with many lenders and can help you to find fast cash when you need it.

Fast cash give borrowers an opportunity to get fast cash when they need it, with direct lenders through our network, even with poor or bad credit.

Borrowers should carefully consider the loan amount and only take what they need. Some lenders may extend the term of the loan up to several weeks, but many require that the loan be repaid within two weeks, except in the case of installment loans. To find lenders who can accommodate various borrowers terms, we recommend that borrowers keep their short term loans as short term as possible.

APR: The equivalent annualized percentage rate (APR) for short term loans or payday loans and other short-term installment loans can range significantly, and often based on the amount borrowed and the length of the loan. One should consider that these loans are only meant to be for a very small time-frame, usually 2 weeks.

Financial Implications: Short term payday loans are meant to be just that: Short term. Fees are typically less than what borrowers can expect to pay for bouncing a check, having a utility disconnected, or paying a credit card bill late.

Credit Score Impacts: Short term, payday loan lenders may rely on any of the three (3) major rating agencies – Equifax, Experian, or Transunion. Generally, the borrower doesn’t necessarily need to be concerned that their score may be affected by having the loan request determined by results from these agencies, however, such determination is solely in the discretion of the payday loan lender(s), which may result in the lender(s) submitting, among other things, the borrower’s request for the loan, or the subsequent payment(s) under the loan to any of these agencies. Short term lenders may also rely on their own scoring criteria, which is generally based on income and ability to repay, as well as the borrower’s payment history of any previous payday loans that have been made with the lender in question, or with other payday lenders.

Collection Practices: In the event that a loan becomes delinquent, attempts at collections are first conducted internally by the lender, not Personal Money Network (we work with lenders but are not a lender) in an attempt to work out a pay-off arrangement that takes into strong consideration the financial condition of the borrower. If, after all attempts at internal collections have failed, the lending agency may send the loan to a third party collection agency in an attempt to recover the funds lent in good faith.

Types of short term loans

Short term lenders generally offer two types of loans: payday loans and installment loans. Payday loans, also known as payday advances, are repaid when the borrower receives his or her next paycheck. Installment loans allow the borrower to make several payments over a few weeks or even months. For both payday advances and installment loans, the lender charges a fee that is paid along with the loan repayment.

Lending process made simple

Applying for a short term loan for bad credit online is similar to applying for a traditional loan in that the borrower provides some basic information and requests a loan amount. Once the lender and borrower agree on the short term loan amount, the fee and the repayment date, the money is directly deposited (by lender) in the borrowers checking account. Unlike a bank loan, the average wait time between loan agreement and cash deposit can be as soon as the next day on average, sometimes more, sometimes less. It is determined by the lender (not Personal Money Network) whether a loan is approved and when it is deposited. Many, but not all, short term lenders may not do a credit check; they base the amount they are willing to lend on the borrowers income. Each lender has their own methods of determining whether a borrower is a ‘safe’ risk and whether they want to issue a loan.

Borrowing responsibly

Small loans should only be used for budget shortfalls and necessities. In many cases, short term cash loans can save borrowers money — especially for borrowers who are facing the possibility of overdraft charges. The average overdraft fee is $35 per occurrence, and the amount by which a customers overdraws the account is not a factor. A bank customer could pay less for a short term personal loan and avoid being charged multiple overdraft charges for negligible amounts. Short term loans can also help borrowers avoid late fees and protect their credit ratings. Depending on the season holiday loans might also be of interest.

Short term loans

It’s easy to apply, so why not get your short term personal loan today?

California – Do Not Sell My Personal Information

California residents have additional or different rights to obtaining the personal information a company has on them and to opt out of their personal information being shared. For more information or to opt-out please review our California Privacy Rights.