Choosing the right loan when you have bad credit can feel impossible, but it doesn’t have to be.

Despite what you may think, there are ways that you can get a loan without having good credit. While you may not qualify for a great APR with a bad credit score, there will still be interest rates that are manageable.

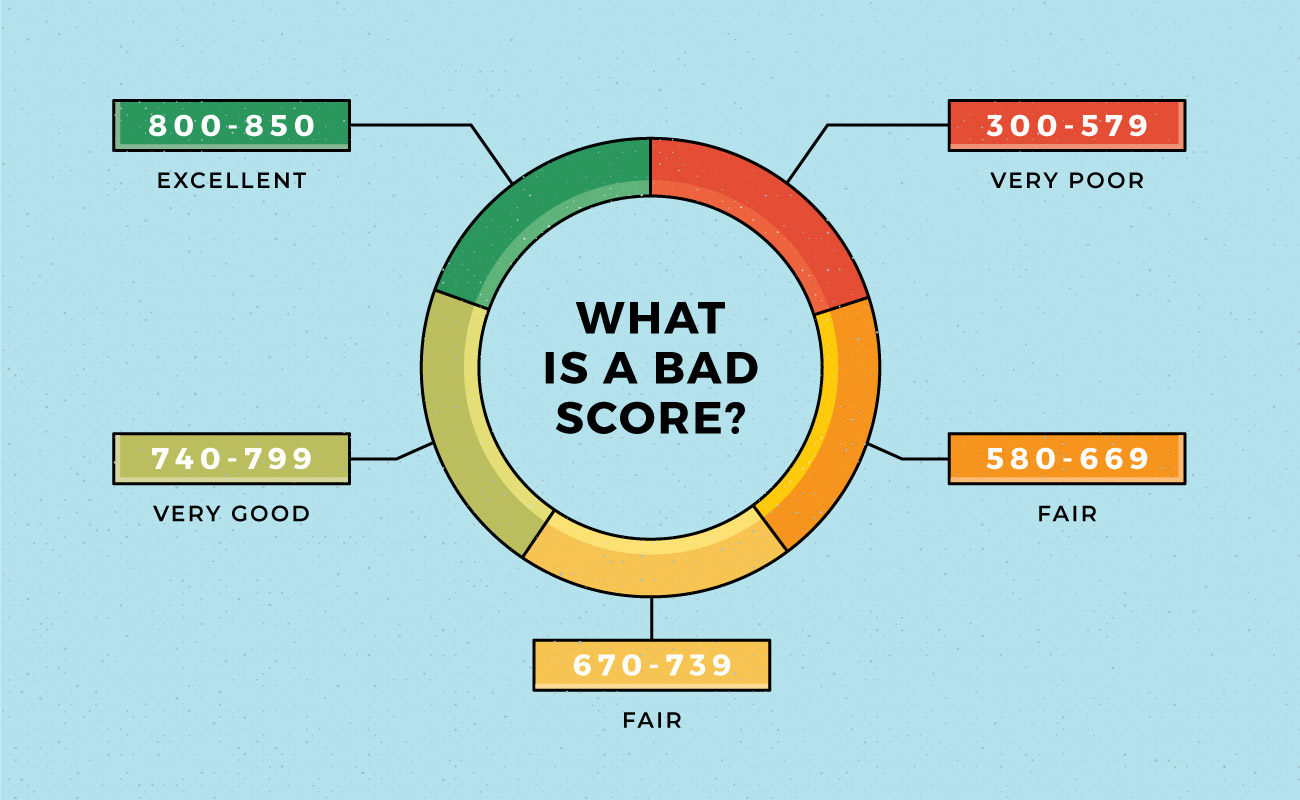

Before you apply for a loan, know where your score ranks among the credit scores list and how it will affect the loan you get.

What Defines a Bad Credit Score?

A credit score that is under 580 is considered to be a bad credit score, and credit scores that are between 581-669 are fair.

If you fall in the “bad” or “fair” category, your chances of getting approved for a loan are slim. However, you still have a chance of getting a loan if you need one, and your chances of getting approved for a loan are better if you fall into the fair category.

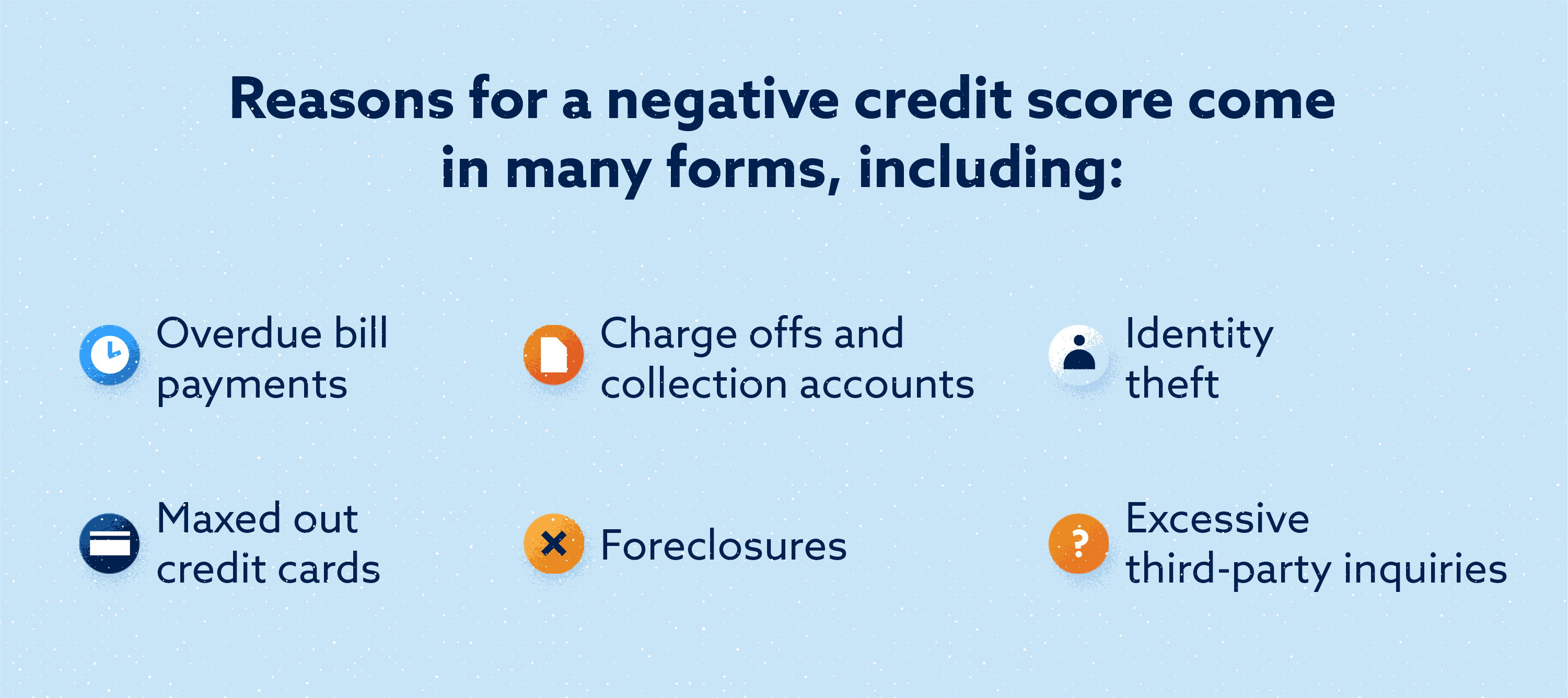

What Creates a Bad Credit Score?

If you’re wondering why your credit score is less than ideal, multiple factors may play into a poor credit history.

No Credit History

Having no credit history can cause its own set of issues. If you are a young adult who has not established a credit line yet, you will not have a credit score.

Keep in mind that while this can cause problems in situations where your credit score is being checked, it doesn’t mean that your credit score is bad.

Having no credit score does not mean that your score is at a 0, but that your score does not exist at all. Also, having no credit score is ultimately better than having bad credit, as it is easier to build credit from a clean slate.

Payment History

Your payment history is one of the biggest contributing factors to a bad credit score.

If you have late payments, then your score is likely to go down. The more late payments that you have, the more your credit score is going to go down.

Having a credit card is tricky for these exact reasons. Payments can be easy to forget about if you are not careful, and once you miss one, it’s hard to catch back up.

How Much You Owe

Apart from having late payments, the amount of money that you owe also affects your credit score.

The more money that you owe, the lower your credit score will be. A good way to improve your credit score is to reduce the amount of debt you owe. While this may seem obvious, keep in mind that even small payments will make a difference.

People get overwhelmed by the big numbers that they do not have, but paying what you can help you in the long run.

Choose the Right Loan

If you have bad credit, you may wonder how you will secure a loan.

There are bad-credit loans available for people with poor to fair credit scores. These kinds of loans are growing increasingly popular as the worldwide pandemic continues to take a toll on the economy.

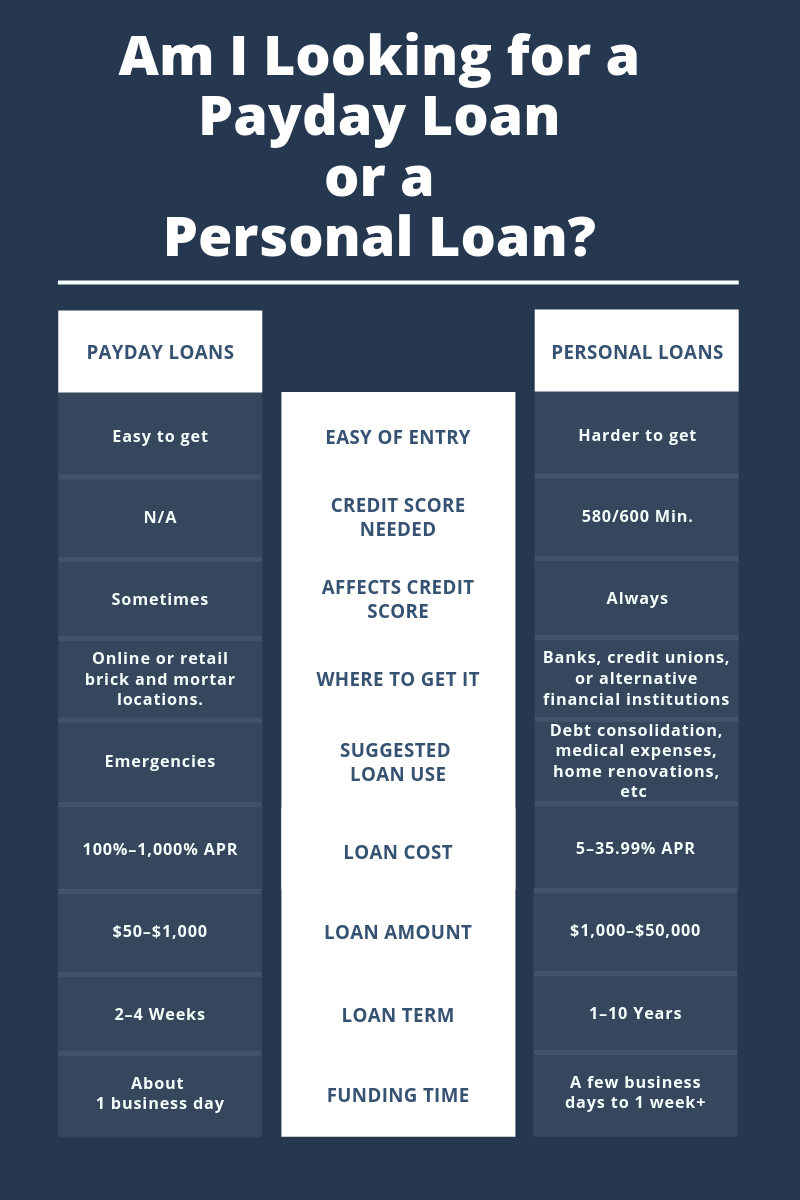

Personal Loans

Personal loans are either secured or unsecured.

If you apply for a secured loan, you will have to put an item down for collateral, such as your home. An unsecured loan does not require collateral but will approve your loan based on your credit score.

Payday Loans

Payday loans are small amounts of money loaned over a short period of time.

While these loans may seem like a dream come true, they usually come with incredibly high-interest fees. They are also usually due within two weeks or your next paycheck, which may not give you enough time to gather the money needed.

Payday loans are viable options if you are in a pinch, however. Just choose a payday loan carefully, and make sure you will pay off the money you owe.

Installment Loans

There are many types of installment loans, you might even have used one in the past. Things like auto and home loans are types of installment loans where you make regular monthly payments. Some are secured, some are unsecured, and the length of time to repay can vary according to the terms.

When the Loan Chooses You

While most can use some kind personal loan for plans or unexpected expenses, when you have poor credit, sometimes you don’t get to choose your options and have to go with what is available to you.

Improving Your Loan Options

Even if you didn’t qualify for a great rate recently, or turned away from most lenders but needed the money and had to use payday loans, you can change things.

By improving your overall credit score you can improve your options. It won’t happen overnight but it is definitely something that is worth working on. Your future self will thank you down the road.